October was a strong month for the UK stock market. The FTSE 100 index reached a 20-month high yesterday, and it looks to me like this steady run could extend into 2022. November looks like a good time to pick up some tested UK shares for my long-term portfolio. My current focus is on established businesses that also have a strong presence in the Asian markets. I am optimistic about the region’s economic expansion. Here are three companies on my UK shares to buy watchlist.

FMCG leader

Unilever (LSE:ULVR) has had a disappointing showing in the market in 2021. At the time of writing this today, its share price is down 11.9% in 2021 and 16.4% in the last 12 months. But I am still confident that the global fast-moving consumer goods (FMCG) giant could be set to turn things around in the coming months. Here’s why.

One Killer Stock For The Cybersecurity Surge

Cybersecurity is surging, with experts predicting that the cybersecurity market will reach US$366 billion by 2028 — more than double what it is today!

And with that kind of growth, this North American company stands to be the biggest winner.

Because their patented “self-repairing” technology is changing the cybersecurity landscape as we know it…

We think it has the potential to become the next famous tech success story. In fact, we think it could become as big… or even BIGGER than Shopify.

Click here to see how you can uncover the name of this North American stock that’s taking over Silicon Valley, one device at a time…

I believe inflation is the main reason for Unilever’s falling share price. But my concerns diminish when I look at Unilever’s international market dominance. Also, any impact to my potential investment from a fall in share price will be plastered over by the strong 3.7% dividend yield.

A lot of its products have built up a loyal consumer base, especially in the beauty and healthcare segment. Also, its performance in key Asian markets like India and China has been strong in 2021, according to the recent third-quarter (Q3) report. Overall, however, the report looked underwhelming to me. Sales growth of just 2.5% is low considering the market share. But a recent hike in prices helped raise margins by 4.1%.

Another concern is the emergence of discount retailers. If inflation concerns persist, even the most loyal Unilever consumer will be forced to switch. But I think Unilever has the potential to ride out the current turbulence. And at 3,916p, I would consider an investment in Unilever shares given its dominance in the FMCG sector.

UK giants with global presence

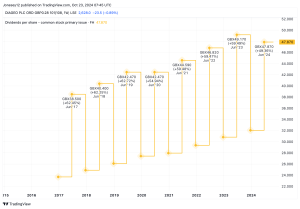

Diageo (LSE:DGE) and Prudential (LSE: PRU) are two UK shares I am looking to buy in 2021. I think both companies offer growth potential, have a strong Asian presence and look like top picks for my portfolio.

I have been watching Diageo for a while now and believe that the alcohol giant is implementing its business strategy well, with long-term growth in mind. The company has a large cash chest of £3.7bn in 2021. Using this, Diageo has already established a strong presence in Latin America and Asia by acquiring top brands.

My concern is the lack of non-alcoholic alternatives in its portfolio. With the emergence of a health-conscious youth, this could be an issue in the future. But for the next decade, Diageo looks like a good investment for my portfolio.

At the time of writing today, Prudential shares were up 49.3% in the last 12 months. It has outperformed UK insurers like Legal & General and RSA Insurance Group. The company has renewed its Asian focus, highlighted by its recent listing in the Hong Kong stock exchange

The uncertainty around China’s economic stability is a major concern with Prudential. But as global economies recover, a crash is looking less likely to me. Prudential could benefit from rising interest rates as the sector recovers from pandemic-driven cuts. This is why it is on my UK shares to buy watchlist.

Suraj Radhakrishnan has no position in any of the shares mentioned. The Motley Fool UK has recommended Diageo, Prudential, and Unilever. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

This post was originally published on Motley Fool