UK investors continue to flock to dividend stocks, and for good reason. These investments offer the potential for capital gains and a steady stream of passive income.

Here, I’m going to highlight three dividend stocks that investors in their 50s may want to consider. These stocks all are slightly defensive in nature but still have the potential to provide attractive total returns (capital gains and income) over the long term.

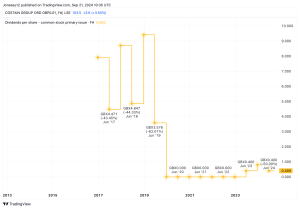

Consistent dividend growth

First up is Coca Cola HBC (LSE: CCH), a bottling partner of the Coca-Cola company.

I see this stock as well suited to those in their 50s for a couple of reasons. First, I don’t think people are going to stop drinking Coke (and related products) any time soon. So the stock’s unlikely to suddenly fall off a cliff.

Second, the yield’s healthy at 3.1% and the company has a great track record when it comes to dividend growth. Since paying its first dividend in 2013, it’s increased its payout every year.

Of course, there’s a chance that consumer tastes and preferences could change in the future. But with the stock trading on a P/E ratio of 14.5 (versus 22 for Coke), I like the risk/reward skew.

It’s worth pointing out that Barclays just raised its target price to 3,100p from 3,000p. That’s about 15% above the current share price.

A long-term winner

Next we have Bunzl (LSE: BNZL). It’s an under-the-radar FTSE 100 company that specialises in providing businesses with essential items such as safety equipment, hygiene products and disposable tableware.

Now, the yield here is only 2.3%. But I don’t see that as a deal-breaker. When it comes to generating wealth for shareholders, this company has a phenomenal track record. Investing in it 20 years ago would have resulted in a roughly seven times gain (and also received regular dividends).

Of course, past performance isn’t an indicator of future returns. And a slowing economy is a risk with this company.

Taking a long-term view though I reckon Bunzl will continue to do well. Analysts at HSBC just upgraded the stock from Hold to Buy and put a 3,460p price target on it.

Growth and defence

Finally, check out Unilever (LSE: ULVR). It’s the owner of Dove, Hellmann’s, Domestos, and a stack of other household brands.

This stock offers a beautiful mix of growth potential and defensiveness, in my view. So it could be very well suited to those in their 50s.

On the growth side, the company has plenty of exposure to the fast-growing emerging markets. It also has a new management team who are determined to get the company into great shape.

On the defensive side, Unilever products tend to be bought throughout the economic cycle. So sales are unlikely to suddenly tank.

As for the yield, it’s about 3.5% today. That’s not super high, but this is another company with a great track record when it comes to dividend growth.

It’s worth noting that a lot of consumers have shifted to cheaper brands in recent years. If this trend continues, the stock could provide disappointing returns.

I think the new management team should be able to reignite interest in the company’s ‘power brands’ however.

This post was originally published on Motley Fool