The Rolls-Royce (LSE:RR) share price has been one of the FTSE 100’s biggest successes of the last 12 months. But I think it might not be done yet.

In a recent interview with Nicolai Tangen, CEO Tufan Erginbilgiç outlined three lines of opportunity for the company. And if earnings keep growing, I expect the stock to move higher.

Sustainable fuel

According to Erginbilgiç, the aviation industry is heading in the direction of sustainability. More specifically, the next 20 years is going to involve a shift to sustainable aviation fuel (SAF).

If this happens, Rolls-Royce is in a strong position. Unlike its competitors, all of the company’s engines are currently 100% SAF compatible.

One issue is that SAF is between two and seven times more expensive than jet fuel. This makes airlines reluctant to use it unless they’re either incentivised to do so, or forced by regulation.

Rolls-Royce therefore needs institutional support to drive this growth opportunity. But a focus on global emissions targets means this might well be a realistic possibility.

Narrow-body aircraft

Another key avenue involves expanding the market Rolls-Royce sells its engines into. The firm has been focused exclusively on wide-body aircraft since 2011.

Erginbilgiç, however, sees the growing narrow-body market as a potential opportunity. The company’s plan is to participate via a partnership with a manufacturer such as Airbus.

Rolls-Royce believes its UltraFan technology can improve engine efficiency by between 10% and 15%. And this could translate into an important opportunity for growth.

A partnership means relying on another company though. With Boeing dealing with quality issues and Airbus struggling to expand production, this could be a risk with this strategy.

Small nuclear reactors

Nuclear power looks increasingly like an important source of energy, especially in Europe. If this turns out to be the case, Rolls-Royce is in a strong position to benefit from this.

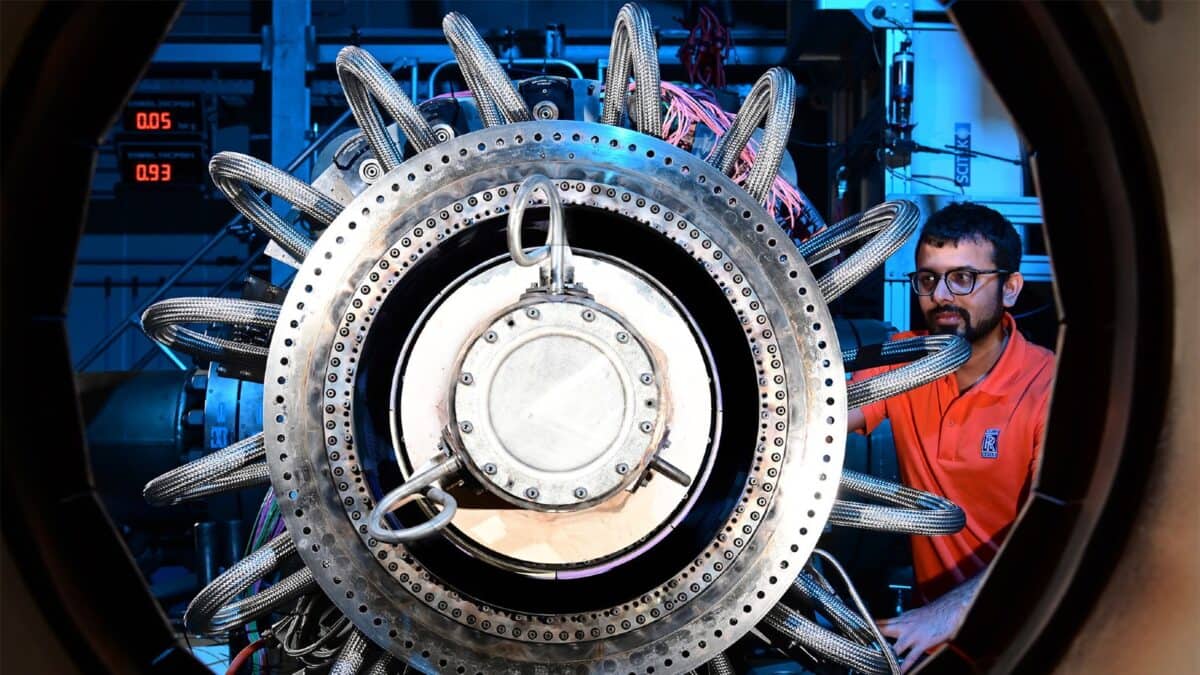

Small modular reactors – which are more flexible and cheaper than their larger counterparts – may well be important. And the company is a leader in this area.

The technology isn’t new, but commercialising it involves an approval process in three phases. Right now, Rolls-Royce is the only firm to have reached the second phase.

Building out the supply chain here will take time. But with net zero targets and energy security to consider, this could be an important source of growth over the next 10 years.

Is it too late to buy the shares?

With the Rolls-Royce share price having climbed 263% in the last 18 months, it’s natural for investors to wonder whether the time to buy the stock has passed.

Obviously, it’s better to buy any stock at £1.51 than at £5.48, but the Rolls-Royce CEO still sees plenty of opportunities ahead. And if the company keeps growing, I expect the stock to follow so it may be worth considering.

This post was originally published on Motley Fool