The intensifying battle to reduce global emissions is likely to supercharge growth in the battery energy storage market. Its a phenomenon that plays directly into the hands of penny stock Bushveld Minerals (LSE: BMN).

Bushveld pulls vanadium — a key component in devices that store energy — out of the ground. It also helps develop projects that use vanadium redox flow batteries. Consequently I expect revenues at Bushveld as investment in renewable energy accelerates.

5 Stocks For Trying To Build Wealth After 50

Markets around the world are reeling from the coronavirus pandemic… and with so many great companies trading at what look to be ‘discount-bin’ prices, now could be the time for savvy investors to snap up some potential bargains.

But whether you’re a newbie investor or a seasoned pro, deciding which stocks to add to your shopping list can be a daunting prospect during such unprecedented times.

Fortunately, The Motley Fool UK analyst team have short-listed five companies that they believe STILL boast significant long-term growth prospects despite the global upheaval…

We’re sharing the names in a special FREE investing report that you can download today. And if you’re 50 or over, we believe these stocks could be a great fit for any well-diversified portfolio.

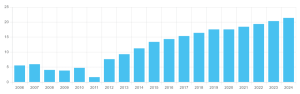

The intermittent nature of natural energy sources means battery energy storage is essential to compensate for when the wind fails to blow and the sun fails to shine. It’s why analysts at Frost & Sullivan think the battery energy storage market will be worth $15.9bn by 2030, up from $2bn last year.

Buying Bushveld shares exposes investors to the volatile mining industry where costs can unexpectedly balloon and production levels can disappoint, delivering a big hit to profits. Still, I think the potential rewards on offer at this penny stock far outweigh the risks for me.

A penny stock for the e-commerce boom

The ongoing e-commerce explosion creates plenty of opportunity for me to make a buck too. I already have exposure to companies which benefit from the rise of online shopping, from packaging manufacturers and logistics businesses to retailers themselves.

And I’m thinking of loading up on Attraqt (LSE: ATQT) as well. This penny stock lets e-tailers provide a personalised shopping experience for their customers using AI algorithms.

This helps retailers to get an advantage in what is an increasingly congested marketplace. The business is trading extremely strongly right now, and it won contracts with £1m worth of annual recurring revenues in the third quarter alone. I think Attraqt is a top buy for me, despite the threat that revenues could sink amid a broader slowdown in consumer spending.

A fashion favourite

The online shopping boom is also causing me to consider buying N Brown Group (LSE: BWNG). In recent years, the retailer has wound down its mail order and bricks-and-mortar operations to concentrate solely on e-commerce.

Its transition to a digital-only model has gone down well with consumers. And the business is accelerating its plans to capitalise on the cyber shopping phenomenon. This includes developing new websites aimed to improve the customer experience.

I also like N Brown because of its focus on making clothing for plus-size and elderly customers. These are fast-growing segments and N Brown has some highly-popular brands to call upon to exploit this to its fullest. These include Jacamo, Simply Be and JD Williams.

More recently, I’ve also been encouraged by the pace at which sales at N Brown’s Home Essentials homewares brand has grown since its launch last year.

However, profits at the penny stock are likely to take a hit as supply chain problems push up costs. But I think it should still have the mettle to deliver me splendid long-term earnings growth.

5 Stocks For Trying To Build Wealth After 50

Markets around the world are reeling from the coronavirus pandemic…

And with so many great companies still trading at what look to be ‘discount-bin’ prices, now could be the time for savvy investors to snap up some potential bargains.

But whether you’re a newbie investor or a seasoned pro, deciding which stocks to add to your shopping list can be a daunting prospect during such unprecedented times.

Fortunately, The Motley Fool is here to help: our UK Chief Investment Officer and his analyst team have short-listed five companies that they believe STILL boast significant long-term growth prospects despite the global lock-down…

You see, here at The Motley Fool we don’t believe “over-trading” is the right path to financial freedom in retirement; instead, we advocate buying and holding (for AT LEAST three to five years) 15 or more quality companies, with shareholder-focused management teams at the helm.

That’s why we’re sharing the names of all five of these companies in a special investing report that you can download today for FREE. If you’re 50 or over, we believe these stocks could be a great fit for any well-diversified portfolio, and that you can consider building a position in all five right away.

Click here to claim your free copy of this special investing report now!

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

This post was originally published on Motley Fool