With inflation cooling and Cash ISA rates likely to drop as interest rates fall, investors are turning to good yields from dividend stocks again.

Some of us never forgot them, mind. And three that I like the look of are due to report in September.

Cash cow #1

House builder Barratt Developments (LSE: BDEV) has full-year results due on 4 September. The share price is down over five years, which helps keep the forward dividend yield at a healthy 5.1%.

For long-term dividend income, I reckon this could be one of the more sustainable. And this yield is in a down year when the business is under pressure. Forecasts show earnings starting to grow again from 2025 onwards.

With the firm’s July trading update, the board said it “intends to declare an ordinary dividend in line with policy, with dividend cover of 1.75 times adjusted FY24 earnings per share“.

We’re not out of the woods, as many people have other costs on their minds. Energy prices are rising, and the humble British fish and chips dinner has gone through the roof.

But even with more short-term uncertainty, I think I’d buy now if I didn’t already own some house builder shares.

Cash cow #2

While eyes turn to finance stock yields, I think the 9.1% forecast for Chesnara (LSE: CSN) has dipped under the radar.

The life sssurance and pensions consolidator has seen its share price fall in the past couple of years.

It’s only a relatively small company, with a £400m market cap, in a big insurance sector. And that’s possibly the biggest risk. Smaller firms might not have the same resilience needed to handle any new downturn quite so well as larger peers.

I reckon that could keep investors away and focused more on big FTSE 100 stocks.

But at the time of FY 2023 results, Chesnara reported a rise in commercial cash generation to £53m, with strong solvency. CEO Steve Murray said “The two acquisitions we delivered in 2023 show we have continued momentum behind our acquisition strategy“.

The company lifted its dividend by 3%. First-half results are due on 10 September.

Cash cow #3

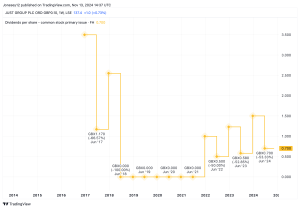

Over at PZ Cussons (LSE: PZC), we’re looking at a 5.1% forward dividend yield. The poor share price chart for the past five years has helped with that.

But if the full-year results due on 18 September are any good, I wonder if we might see the start of an upturn.

One problem is that Cussons has had a tough time in Nigeria, which made up more than a third of its 2023 revenue.

Still, in June’s trading update, the firm said it held minimal surplus cash in Nigeria. And we were reminded of the “plan to maximise shareholder value from a portfolio transformation, following a strategic review of brands and geographies.“

“An update will be provided when appropriate“, the board added.

The risk through uncertainty seems clear. But if Cussons can align itself with upbeat forecasts, we could see the stock valuation fall and the dividend cash grow.

This post was originally published on Motley Fool