Looking for the best FTSE 250 bargain shares today? Here are three I’m tempted to buy when I next have spare cash to invest.

City brokers think their share prices could surge as much as 29% over the next year!

Bank of Georgia Group (LSE:BGEO)

Emerging market shares can be much riskier than those operating in the developed world. This has certainly been the feeling when it comes to Bank of Georgia Group shares more recently.

Civil unrest in response to political changes in the country threatens economic growth. However, the potential rewards of investing here are also considerable. Pre-tax profits have surged 168% since 2019 as demand for financial products has heated.

Currently, four City analysts are evaluating the bank. And today, each recommends the business as a Buy.

Additionally, the consensus among brokers indicates significant growth potential for Bank of Georgia’s share price over the next year. They predict it will rise to £54.94 per share within the next year, up from the current price of £42.65.

This estimate marks a substantial 29% premium over today’s price.

Chemring Group (LSE:CHG)

Supply chain problems persist across the aerospace and defence industry. But businesses like Chemring Group still have an exceptional chance to grow earnings as arms spending in the West reignites.

This particular defence giant specialises in countermeasure technology, like chaff cartridges fired from fighter jets to confuse missile targeting systems. And sales are soaring right now. Indeed, Chemring printed a record order intake of £345m in the first half of 2024.

Out of six analysts appraising the FTSE 250 firm, five recommend it as a Buy, while one has placed an Underperform rating. This latter categorisation suggests a share will perform less impressively than the broader sector.

Analysts also expect Chemring’s share price to climb significantly over the next year. They have set an average price target of 446.3p per share, up from 382.5p presently.

This represents a robust 17% premium over today’s price.

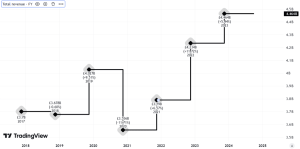

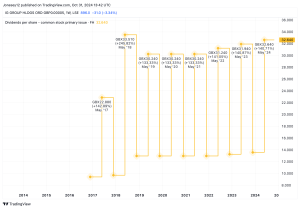

Games Workshop Group (LSE:GAW)

Tabletop gaming remains a niche activity. But it’s soaring in popularity all over the globe, giving Games Workshop Group a brilliant opportunity to supercharge revenues.

The business designs, manufactures and sells miniatures, books and games systems through its stores and website. Competition is growing, and the threat from counterfeit products is on the rise. But products like Warhammer: 40,000 should still remain in high demand thanks to their exceptional quality.

And the company’s looking to exploit this more effectively by licensing its intellectual property (IP) to giant programme and film producers like Amazon. This could take revenues to the next level.

Currently, four brokers have positive ratings on Games Workshop shares, each have a Buy rating.

And similar to Bank of Georgia and Chemring, brokers agree that Games Workshop’s share price is poised for significant appreciation in the near future. The 12-month price target is set at £124, a notable increase from the current price of £103.90.

In fact, this projection’s an 18% premium over today’s price.

This post was originally published on Motley Fool