As we survey the global stock market winners and losers of 2024, it’s fair to say that Tesla (NASDAQ: TSLA) occupies the former category. But how much would an investor have made if they’d bought £20,000 worth of the electric car company’s shares at the beginning of the year? And would they be wise to quit while they’re ahead?

Ending 2024 with a flurry

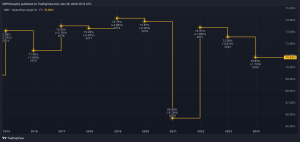

Tesla’s massive 68% gain belies the fact that the vast majority of this return only came in the last couple of months. For much of the year, the stock has been quite volatile, bouncing between a range of $150 and $250 a pop. That behaviour makes quite a bit of sense considering the mixed news flow surrounding the company and its ‘unique’ CEO.

While vehicle production passed the seven million milestone, a substantial number of cars were recalled for potentially dangerous glitches (like faulty warning lights). Tesla also experienced difficulty in meeting some analyst projections, although at least some of this was due to investment in other projects. The unveiling of the Cybercab was met with some derision too.

However, none of that seemed to matter once Elon Musk chose to enthusiastically back Donald Trump’s campaign to return to the White House. The latter’s subsequent election victory in November — and the likelihood that he would shake up regulation to benefit the former — put a veritable rocket under the Tesla share price.

Going back to our investor, a quick calculation leaves their initial £20,000 stake now being worth £33,600. That’s a wonderful return, of course, and further evidence of how lucrative stock picking has the potential to be.

But I reckon it leaves holders in a tricky spot.

Is Tesla now dangerously overvalued?

At $1.31trn, Tesla’s market capitalisation still significantly lags other members of the Magnificent Seven. However, the stock now stands head and shoulders above everything else in terms of valuation. That doesn’t mean it can’t go higher in 2025. But the Austin-based business probably needs to start blowing the doors off in terms of earnings growth. Speaking of which, the next set of numbers should be with us by late January.

Whether Musk’s blossoming friendship with Trump begins to wilt or not, I can’t help but think that his involvement in the new administration also means he’s in danger of spreading himself even more thinly. Surely there must come a point — critics would say we’re already there — where spinning so many plates risks impacting his judgement?

Wise to bet against Musk?

Notwithstanding this, betting against the world’s richest person hasn’t worked so far. I remember when it felt like every trader and his dog was short-selling Tesla stock. While I never joined them, I was certainly sceptical as to whether the company could truly deliver. More Fool me.

One should also remember that Tesla is a multi-headed beast. Indeed, galloping sales at its energy generation and storage division had a big hand in allowing the company to report better-than-expected earnings over Q3.

All that said, I prefer to get my exposure to Tesla shares via funds and trackers rather than directly. While this means I missed out on the big gain delivered in 2024, it’ll help to cushion the blow if 2025 isn’t quite so kind.

This post was originally published on Motley Fool