A price-to-book (P/B) ratio measures the share price in comparison to the book value of the business. The book value is essentially the total assets minus liabilities of a firm. A ratio between one and two is fair, but sometimes lower values can indicate a stock for investors to consider buying. Here are two potential value shares with low ratios.

Growing earnings

The first one is Standard Chartered (LSE:STAN). The stock has jumped by 56% over the past year, yet based on the P/B ratio, I can still refer to it as a potential value share.

The P/B ratio is 0.7, meaning that the market cap is lower than the book value of the company. This could reflect that even with the recent rally, the stock is still undervalued. If the share price keeps moving higher, it would act to increase the ratio back to one.

Investors have been impressed so far this year, with financial results showing growth in different divisions. For example, the latest Q3 results showed profit before tax up 41% versus the same quarter last year, driven by a “record quarter in Wealth Solutions and strong growth in our Global Markets business”.

Earnings per share has increased over the past year, which has pushed up the price-to-earnings (P/E) ratio to 14.67. Some will use this to say that the stock isn’t undervalued, as it’s above the benchmark figure of 10. Yet it’s important to remember that the average FTSE 100 P/E ratio is 15.5, so it’s still below average.

One risk is that the bank is likely to have some negative impact from interest rate cuts over the next year. This comes from markets such as the UK, the US, and Europe.

An encouraging outlook

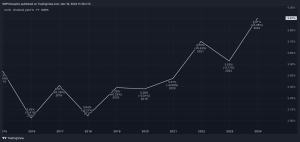

Another stock to monitor is TP ICAP (LSE:TCAP). With a P/B ratio of 0.85, it ticks the box of being notably below average. The stock is up 36% over the past year, but still below levels seen before the pandemic crash in early 2020.

I think the low ratio reflects some investor caution around the interdealer broker. ICAP makes money by connecting financial institutions together for large trades. It only makes a thin margin, but given the trades can be exceptionally large, it’s a profitable line of business. Yet the low margins could be a concern to some, hence why the ratio is low.

I also note that the P/E ratio is below 10, at 8.87. Given that earnings are based on how volatile the markets are, I understand why the company might be undervalued. Investors usually want more stable companies in their portfolio.

However, the rally in the past year (backed up by record Q3 revenue) gives the stock momentum heading into 2025. Given the geopolitics and focus on central banks, I think markets could remain volatile, certainly for H1.

I think both ideas are value stocks that investors can consider adding to their portfolios.

This post was originally published on Motley Fool