I’m searching for the best exchange-traded funds (ETFs) to add to my Self-Invested Personal Pension (SIPP) in the New Year. Here are two on my shopping list today.

Tech titan

This has been a blowout year for tech stocks, and especially those located in the US. If fresh research from eToro is anything to go by, investor interest in this share class could surge again in the New Year.

According to a survey of clients, “when asked which sector they were most likely to increase their allocation to in 2025, tech stocks were by far the most popular answer at 17%“, eToro said. This was ahead of second-placed financial services, which polled 10%.

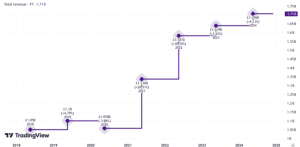

I opened a position in the iShares S&P 500 Information Technology Sector ETF (LSE:IUIT) in July. And I’ve added to it several times since, enjoying juicy returns in the process. It’s near the top of my list of ETFs to buy in the New Year, too.

Since 2019, it’s delivered an average annual return of 24.9%. This concentration on tech stocks mean its delivered a better return than the S&P 500 average of 15.4% over the same timescale.

As you’d expect, the fund provides exposure to some of the so-called Magnificent Seven tech stocks. Its holdings in Apple, Microsoft, and Nvidia account for just below 58% of the total fund.

However, the fund also has holdings in 66 other tech companies. This provides investors with a way to reduce risk while also capitalising on growth opportunities elsewhere.

As you’d expect, the cyclical nature of the fund means returns could disappoint during economic downturns. But I’m expecting it to continue outperforming over the long term, driven by rising adoption of technologies like artificial intelligence (AI), robotics, and quantum computing.

I already have meaningful exposure to the global mining sector. This is thanks to my large holdings in Rio Tinto, along with some diversified funds and trusts in my portfolio.

But I’m looking for ways to increase my stake to mining companies. The current downturn means that many metals producers — and by extension mining funds — look dirt cheap to me at current prices.

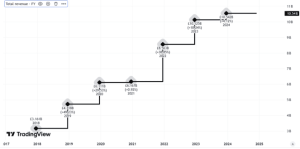

The VanEck Global Mining ETF (LSE:GIGB) is one fund I have my eye on. Designed to track the S&P Global Mining Reduced Coal Index, it excludes shares that extract thermal coal, which in turn reduces the risk I face as cleaner energy sources take over.

In fact, I’m planning to boost my metals exposure in order to capitalise on the accelerating green revolution. Growing renewable energy capacity, rising electric vehicle (EV) sales, and updating power grid infrastructure will all require vast amounts of metal.

The VanEck Global Mining ETF holds shares in 129 producers including big hitters BHP, Rio Tinto, Freeport-McMoran and Glencore. So it gives me exposure to many metals for which demand it tipped to surge like iron ore, copper, lithium, and aluminium.

Since 2014, the fund’s delivered an average annual return of 10.95%. Its broad mining industry exposure doesn’t eliminate the threat of operational problems like disappointing exploration results and production outages. But it does reduce the risk to overall returns.

This post was originally published on Motley Fool