Investors who want to eliminate the possibility of losing money entirely probably shouldn’t buy shares. Even the safest stock market investments have a chance of going wrong.

The key to investing well though, is working out when the potential risks are worth the expected rewards. Here are two UK stocks I think are interesting from this perspective.

Synthomer

Synthomer’s (LSE:SYNT) a speciality chemicals firm that’s been having a tough time since the pandemic. And this shows up in the company’s balance sheet.

According to its latest update, net debt has gone from £500m to £560m over the last six months. That puts it at 4.7 times EBITDA, which is a lot for a cyclical business – and this is the big risk.

For many, that might be enough to put them off Synthomer entirely. But there’s also plenty to be positive about that I think makes it worth a look for investors.

Synthomer P/S ratio 2015-24

Created at TradingView

First – and most obviously – the stock’s unusually cheap at the moment. On a price-to-sales (P/S) basis, it’s trading at some of its lowest levels for a decade.

Second, the company has been dealing with unusually low demand from its end markets, especially construction. This has been going on for some time, but I don’t see it lasting forever.

The firm’s net income’s expected to be negative, but free cash flow this year should be positive. Investors who are able to be patient could find there are big rewards when things pick up.

Taylor Wimpey

Along with other UK housebuilders, Taylor Wimpey’s (LSE:TW) being investigated by the Competition and Markets Authority (CMA). And the outcome’s very uncertain.

That makes the shares risky. And unlike Synthomer, it’s not as though this is reflected in a low P/S multiple – Taylor Wimpey’s trading roughly in line with its historic levels.

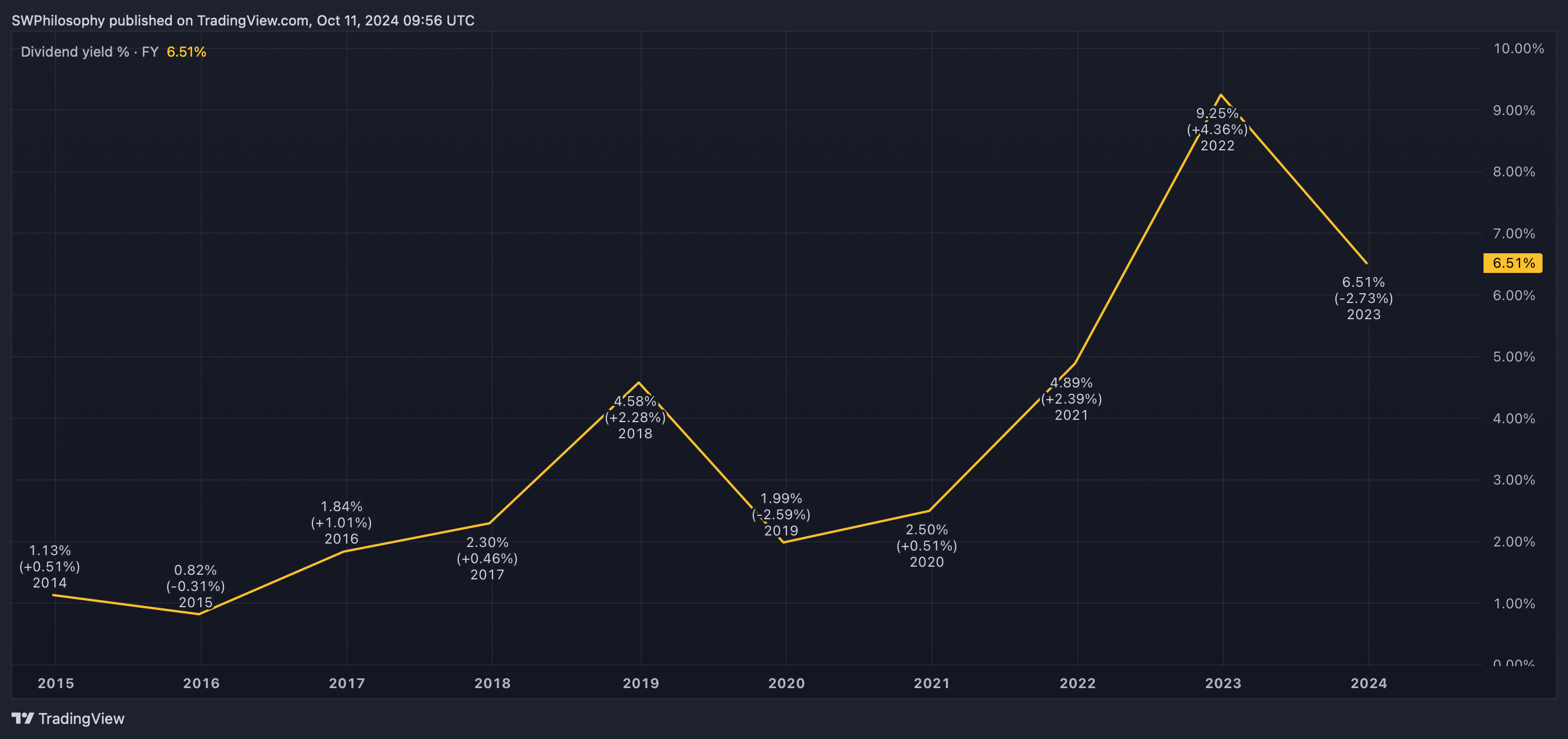

What investors do get though, is an unusually high dividend yield. At the moment, it’s above 6%, which is well above its average over the last decade.

Taylor Wimpey dividend yield 2015-24

Created at TradingView

A high yield can sometimes be a sign investors are worried about the dividend being cut. But with Taylor Wimpey, I think it’s easy to overestimate the danger of this.

The company bases its dividend on its assets, rather than its cash flows. This makes it more durable in the event of a downturn and is the reason I’d consider it over other housebuilders.

As a result, I think Taylor Wimpey might be a good stock for investors looking for passive income to consider buying. Despite the uncertainty, the dividend could generate good returns.

Risks and rewards

Even by ordinary stock market standards, I’d suggest both Synthomer and Taylor Wimpey are unusually risky. In each case, though, I can see the potential for big returns if things go right.

Synthomer’s stock could climb sharply when its end markets recover. And if Taylor Wimpey comes through the CMA investigation, investors could be collecting dividends for a long time.

I wouldn’t make either a big part of my Stocks and Shares ISA. But I do think they could be interesting additions to consider for a diversified portfolio for investors prepared to tolerate the risks.

This post was originally published on Motley Fool