For investors looking to build passive income, UK dividend stocks can offer a steady stream of cash.

The FTSE 100 index has an average dividend yield of around 3.5% right now. That’s pretty good, but there are some companies with payouts of 5% or more. That means a £20,000 investment could potentially generate over £1,000 in annual dividends.

Here are two well-known financial services companies that have strong yields and long records of steady dividend payouts.

Pensions and insurance giant

Legal & General (LSE: LGEN) is one of the UK’s biggest financial services firms, specialising in pensions, life insurance, and investment management. It has been a staple of the FTSE 100 for years and is well-known for its solid dividend policy.

The stock is yielding 8.8% as I write on 24 February — significantly above the Footsie average.

Over the past decade, the company has either maintained or increased its dividend. That consistency is a key reason why many income investors follow the stock closely.

In its most recent update, the company reaffirmed its commitment to paying out dividends, while acknowledging challenges including ongoing market volatility and low margins.

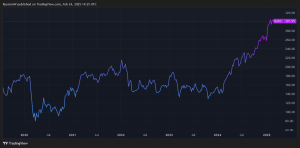

The share price has had a mixed performance lately, moving in line with broader financial sector trends. While it has recovered from some lows in 2023, it still remains below pre-pandemic levels.

Steady dividend payer

M&G (LSE: MNG) is another financial services giant. The company has a £5bn market cap and is best known for its investment management and savings products. Like Legal & General, it has built a reputation for steady dividend payouts.

The company currently boasts an even higher yield of 9.5%. That’s one of the highest in the Footsie and means a £20,000 investment could return nearly £2,000 in annual payouts.

However, there are some risks to consider. M&G’s share price fell by more than 10% in 2024, reflecting investor worries about economic conditions and potential pressure on profits.

While the company remains committed to maintaining its dividend, a yield this high sometimes signals uncertainty. Recent share price falls raise the risk of a ‘value trap’ where investors are lured by high yields only to see subsequent dividend cuts.

That being said, M&G has a history of rewarding shareholders, and it has stated that dividends are a key part of its strategy.

If the company can arrest recent outflows and continue to regain its long-term earnings stability, then the strong dividend payouts could continue.

Too good to be true?

When dividend yields climb this high, it’s often worth asking why. The market may be pricing in risks for both companies given they’re exposed to interest rate moves, regulatory changes, and market downturns.

If profits drop, dividends may need to be cut. This is just one reason why portfolio diversification is so important.

Investing a £20,000 lump sum into either of these two companies may be tempting, but I would much rather spread my risk across many shares in the market to avoid concentration risk and large portfolio movements driven by one or two names.

Of course, these are just a couple of high-yield stocks that investors should consider. Others within the Footsie may be able to offer £1,000 in potential annual dividends from the same investment while operating in different sectors and reducing overall portfolio risk.

This post was originally published on Motley Fool