Growth stocks can be great investments for generating wealth. But the best businesses can increase their revenues and profits while also distributing cash to shareholders as dividends.

There are a couple of companies I think are especially interesting from this perspective. And analysts seem to agree at the moment.

Games Workshop

Shares in Games Workshop (LSE:GAW) are up 35% over the last 12 months. Nonetheless, the three analysts covering the stock still seem to think investors should consider buying it.

The stock looks expensive at a price-to-earnings (P/E) ratio of around 29. But the company’s low capital requirements allow it to distribute almost all of its income to shareholders as dividends.

As a result, Games Workshop shares currently come with a dividend yield of almost 3%. That’s close to the FTSE 100 average from what I think is an extremely high-quality business.

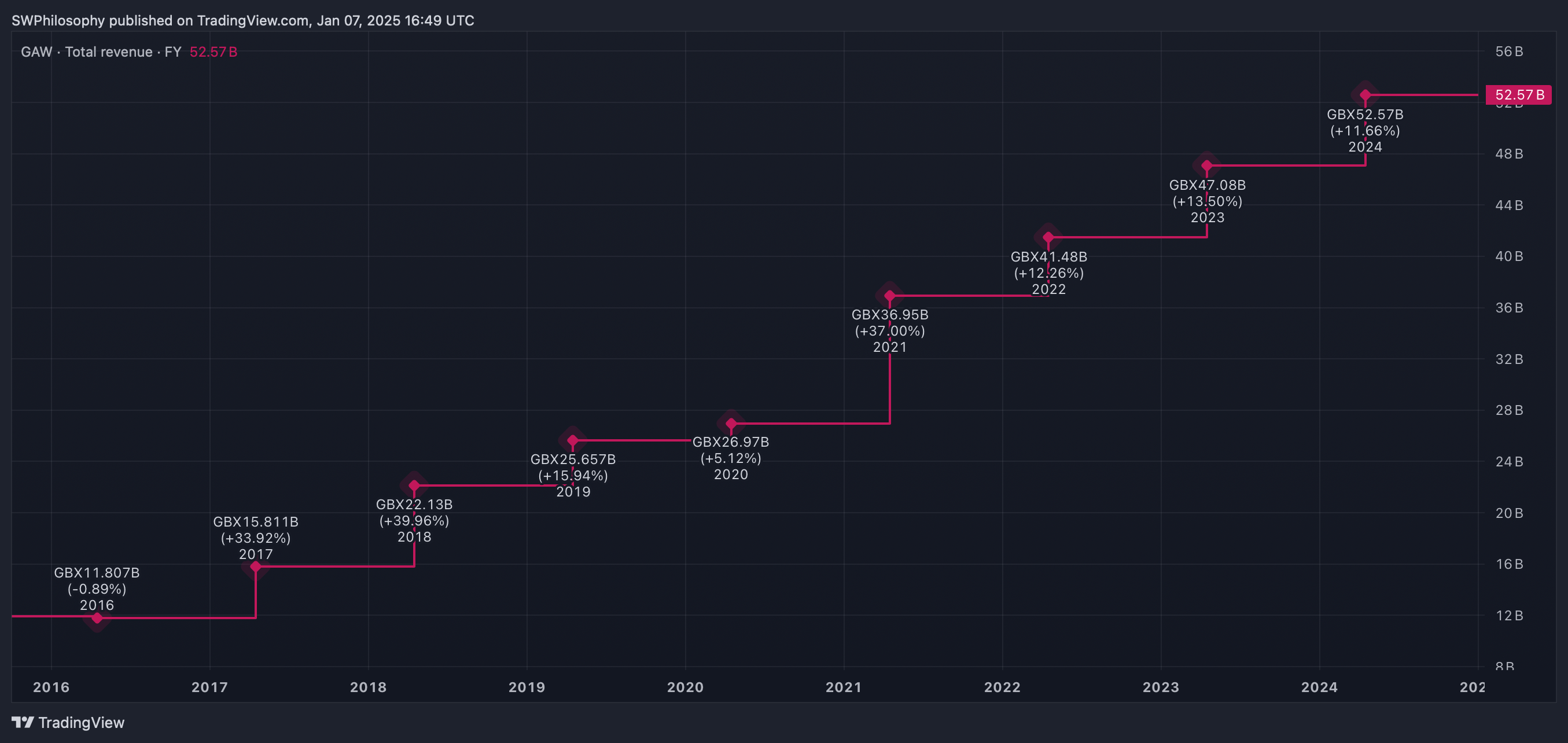

Over the last decade, the company’s grown its revenues at an average of almost 16% a year. And the most impressive thing is it’s done this while reinvesting almost none of the cash it’s generated.

Games Workshop Total Revenues 2015-24

Created at TradingView

The biggest risk with Games Workshop is demand. While its Warhammer products are extremely popular, they’re also non-essential and therefore at risk during downturns in consumer spending.

Investors should therefore be prepared for ups and downs. But I think the firm’s strong intellectual property and impressive cash generation make this a good stock to consider buying.

James Halstead

James Halstead (LSE:JHD) manufactures vinyl flooring for commercial venues. And despite the share price being down almost 9% over the last year, it still attracts a Strong Buy analyst rating.

Revenues fell almost 10% during 2024. The company put this down to weaker demand due to an economic downturn in the UK and Europe – two of its largest markets.

That’s an ongoing risk with the business. But there’s also a lot to like about it and I think investors should see the decline in the share price as an opportunity to consider buying the stock.

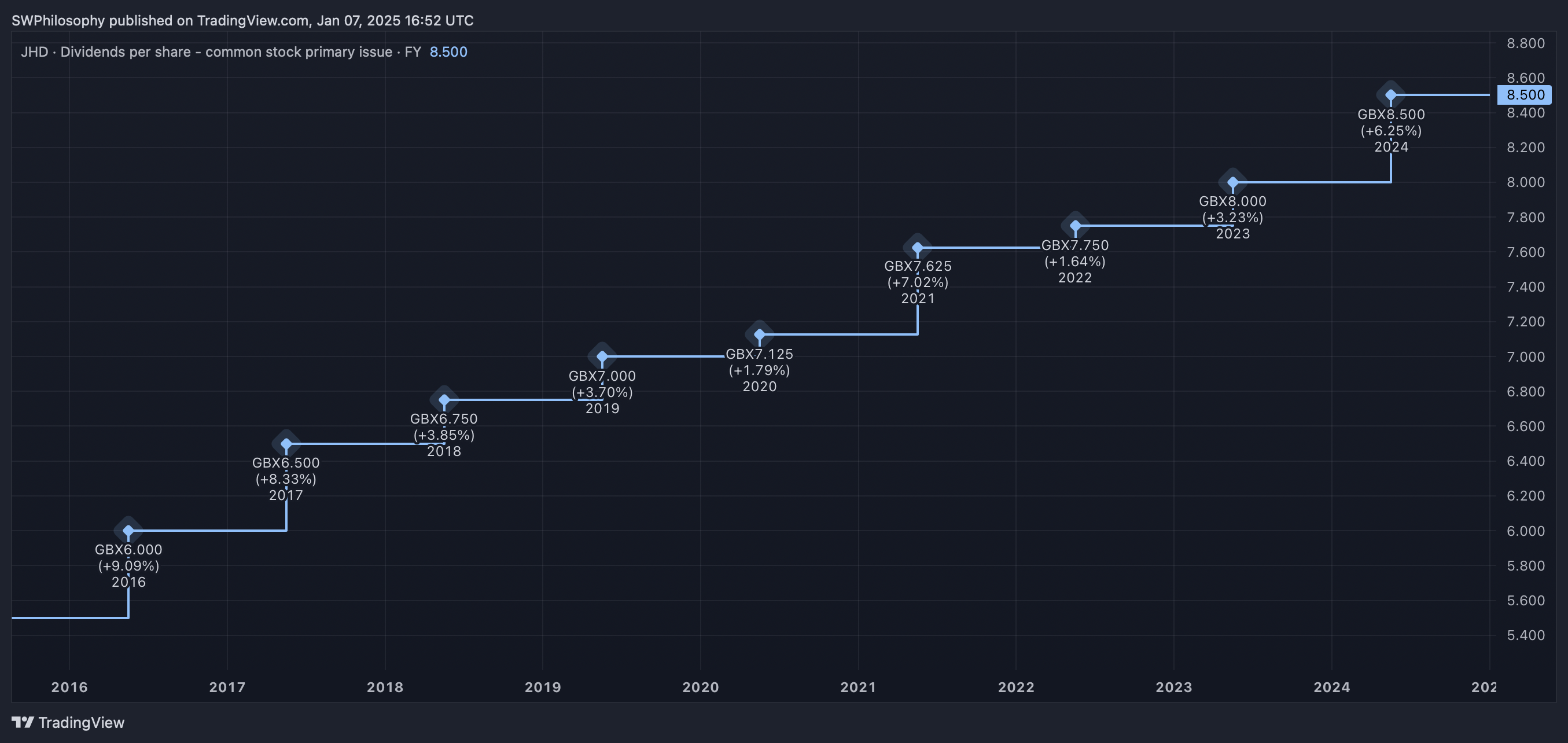

Like Games Workshop, James Halstead distributes the vast majority of its net income to shareholders. And it has increased its dividend each year for almost half a century.

James Halstead Dividends 2015-24

Created at TradingView

Right now, the dividend yield’s 4.72%. And that compares favourably with the return on offer from a 10-year government bond, which is currently 4.6% a year.

This means that, even before thinking about future growth, investors have a good chance of doing better with the stock over the next decade than with a bond. And that’s why I think it’s one to consider buying.

Quality shares

Games Workshop and James Halstead both come with Strong Buy recommendations from analysts. While these are likely driven by short-term considerations, I think long-term investors should take a look.

Both businesses have the ability to keep growing while returning cash to shareholders. That’s something I think marks them out as quality companies that are worth considering.

This post was originally published on Motley Fool