Is investment about timing? It is not only about timing of course, but timing can be very important. The same share can be a brilliant performer or a total dog for an investor, depending on when they buy or sells it. So when looking for shares to buy, I consider how attractive the business is – but also at what point I would be happy to invest.

Here are two shares on my watchlist that I think are excellent businesses. I would be happy to buy shares next year if their price comes down to what I see as an attractive level.

Dunelm

At face level, Dunelm (LSE: DNLM) might not even seem expensive. After all, its price-to-earnings ratio of 14 is lower than that of some shares I bought this year, such as Diageo.

However, I have been burnt owning retailers’ shares before (such as my stake in boohoo).

Retail tends to be a fairly low profit margin business, so earnings can fall significantly for relatively small seeming reasons. Last year, for example, Diageo’s after tax profit margin was 19%. Dunelm’s was less than half of that, at 9%.

Dunelm’s business is run efficiently, it has a large shop estate, and growing digital footprint and thanks to many unique product lines it can differentiate itself from competitors. Sales have grown considerably in recent years.

Created using TradingVew

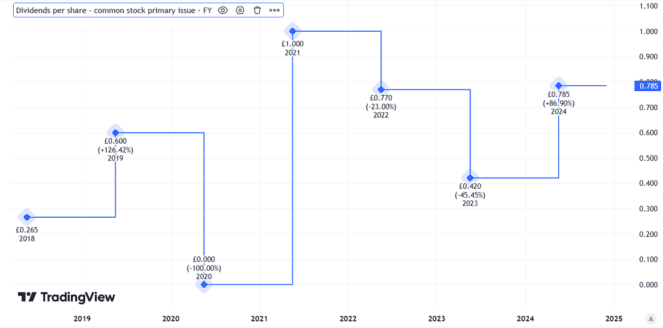

Dunelm is a solid dividend payer too. The yield from ordinary dividends is around 4.1%.

But the company has often paid special dividends, meaning the total yield has often been higher than the ordinary dividend yield alone.

Created using TradingVew

Still, the Dunelm share price has risen 57% since September 2022.

That looks steep to me given that sales growth in the most recently reported quarter was 3.5% — perfectly respectable in my view, but not spectacular.

A weak economy and increasingly stretched household budgets could eat into sales and profits in 2025, I reckon. If that happens and the share price falls enough, my current plan would be to buy some Dunelm shares for my portfolio.

Nvidia

I reckon it is easy to look at the Nvidia (NASDAQ: NVDA) price chart and immediately think “bubble!”

Indeed, the P/E ratio of 53 offers little or no margin of safety for risks such as a pullback in AI spending once the initial round of big installations currently underway has run its course. That helps explain why I have not bought the shares this year.

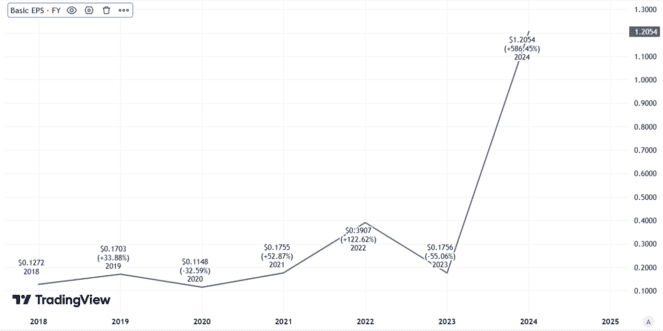

Still, that P/E ratio is despite Nvidia stock rising 2,175% in the past five years alone. The price has soared, but so too have earnings.

Created using TradingVew

Nvidia is not some meme stock without a long-term future. It is a hugely profitable, successful company with a proven business model.

Its competitive moat is also huge in my view – rivals simply cannot make many of the chips Nvidia does even if they want to.

The valuation alone is why I have not bought Nvidia stock this year. It is a share I would be happy to buy (in spades) in 2025 if the price looks more reasonable to me.

This post was originally published on Motley Fool