Nvidia was one of the global stock market darlings of 2024. This was mostly as a result of being at the forefront of artificial intelligence (AI) for the year. Yet due to the exceptional share price rally (almost 200%) in the stock, some investors are looking for alternative growth stocks that could lead the way next year. Here are two to consider as we get ready to start the year.

More specialist chips

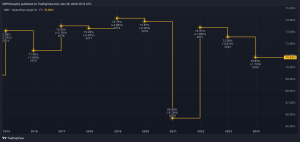

The first one is Broadcom (NASDAQ:AVGO). The US stock enters 2025 on a hot streak already, with the share price up 54% in the past month. This has pushed the gains over the last year to 118%.

It has soared recently as investors try and find options that are viable alternatives to expensive chips from Nvidia. Not only does Broadcom tick this box, but it’s also becoming a frontrunner in custom chips. For example, Nvidia does well with general-purpose graphic processing units (GPUs). Yet Broadcom has expertise in making Application-Specific Integrated Circuits (ASICs), which are more customisable for companies with specific AI needs.

Given that 2025 could see AI become a lot more specific as companies try to carve out a niche to win customers, Broadcom could see demand surge. As a result, I’d expect this to filter down to better financial results. In turn, this should help it to a higher share price.

As a risk, Broadcom is trying to expand out of just hardware sales. This was noted with the recent purchase of VMware. However, I think the business needs to focus on what it’s good at, with other operations potentially becoming a distraction.

Armed and ready

A second option is Arm Holdings (NASDAQ:ARM). Over the past year, the stock is up 87%. The company is renowned for processor designs that are widely used in mobile devices. Yet the business is now pushing hard into AI and machine learning.

The latest quarterly results highlighted that with the industry buying more chips and needing more complexity in the chips, the result will be higher demand for Arm products. As the report noted: “The concept of AI everywhere is increasing demand for Arm’s highly performant and energy-efficient compute platform.”

Looking forward to next year, the continued development of specialised processors could challenge the dominance of Nvidia in certain applications. This would be in a similar way to what Broadcom could do.

However, investors need to be cautious due to the ongoing legal battle with competitor Qualcomm. This centres around the intellectual property licensing agreements that Qualcomm obtained through acquisitions in recent years and that Arm disputes.

Both AI growth stocks could do well next year and I feel investors could carefully consider both if they are looking to add exposure to this area.

This post was originally published on Motley Fool