A Self-Invested Personal Pension (SIPP) is for savers who are confident enough to manage their own investments. This DIY pension can be a great way to boost funds for retirement.

Here, I’ll show how an average sum could turn into a sizeable amount over time.

From £12k to £15k in the blink of an eye

The average UK adult has just under £12,000 in cash savings, according to online sources. If I put this into a SIPP, the government will add in another £3,000 in tax relief, bringing the total contribution to £15,000.

This is how it would work:

- My contribution: £12,000

- Government tax relief: £3,000

- Total in SIPP: £15,000

For higher-rate and additional-rate taxpayers, further tax relief can be claimed back via the self-assessment process.

Building a portfolio

So, let’s assume I’m a basic-rate taxpayer and I’ve now got £15k sitting in my SIPP. Next, I’d have to decide what investments to make. In other words, which shares to buy.

One thing I wouldn’t do is put all my eggs in one basket/stock. I reckon £15,000 spread evenly across six different shares would be a great start. This would provide a level of diversification.

In my own SIPP, I have a number of growth and dividend stocks, as well as a smattering of investment trusts and exchange-traded funds (ETFs).

This is how my balanced portfolio might look at first then:

- Two growth stocks

- Two dividend stocks

- One investment trust

- One ETF

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

A cheap income stock to consider

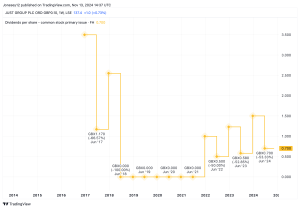

A FTSE 100 dividend stock I hold and would consider again is HSBC (LSE: HSBA). The share price is up 10.5% over the past year as the banking giant has posted record profits amid higher interest rates.

However, trading at just 7.5 times earnings, the stock still appears to present tremendous value. There’s also a dividend yield of 7.2% on offer, which towers above the FTSE 100 average.

One concern here is China, the Asia-focused bank’s biggest growth market. The world’s second-largest economy has been misfiring since Covid lockdowns, and there’s a risk things could take a turn for the worse. Rising US-China tensions could also be a headache for HSBC.

Long term though, I’m bullish on its prospects across Asia. This region is home to a booming middle class and a rising number of wealthy individuals.

I think the bank’s pivot eastwards will eventually pay off in the shape of higher dividends and (hopefully) a higher share price.

The beauty of SIPPs is that I can’t start taking money out until I’m at least 55, rising to 57 in 2028. So for most investors, this gives plenty of time for stocks like HSBC to fulfil their ultimate potential.

Aiming even higher

Naturally, this makes SIPPs incredibly powerful vehicles to allow compounding to work its magic (earning interest upon interest).

If I can generate an average of 10% return over the long run, this would see my £15,000 transformed into £261,741 after 30 years.

Of course, my return might end up lower or higher than 10% and dividends aren’t guaranteed. But it still shows what’s possible given enough time.

If I decided to invest a further £200 a month (which the government tops up to £250), my SIPP would grow to £777,841, assuming the same 10% return.

This post was originally published on Motley Fool