The easiest way I have found of making money with minimal effort – ‘passive income’ – is from dividends paid by shares.

I started buying such stocks over 30 years ago now, but the earlier the better in my view. Why? For a start, the longer the period, the greater the chance that a market can recover from any big shock. The same applies to individual stocks.

From its launch on 3 January 1984 to 3 January 2024, the FTSE 100 has grown 670%. This does not include the dividends paid by stocks over that period or the effect of ‘dividend compounding’ on these returns.

This is where the dividends paid are used to buy more of the shares that paid them. It is the same idea as compound interest in a bank account, and it effectively turbocharges the payouts.

A prime passive income share?

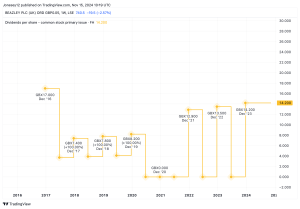

I bought BT (LSE: BT.A) shares recently based on three key factors.

First, on the current £1.36 share price, last year’s 8p dividend generates a yield of 5.9% a year. This already compares very favourably to the present average FTSE 100 payout of 3.7%.

I also think BT’s yield may increase, as dividends (and share price) are driven by rising company earnings over time.

The main risk to this for the firm is intense competition in the telecommunications sector. Indeed, 20 August saw rival Sky announce its launch of broadband services on internet provider CityFibre’s network.

However, consensus analysts’ estimates are that BT’s earnings will increase 12.2% each year to the end of 2026. These healthy growth prospects are the second reason I bought the stock.

The third is that the present £1.36 stock price looks 75% undervalued to me on a discounted cash flow basis. This implies a fair value for the shares of £5.44.

It may go lower or higher than that, of course. But such an undervaluation reduces the chance of my dividend gains being wiped out by a sustained share price fall.

How much income can be made?

£11,000 (the average UK savings amount) invested in BT shares now will make £649 in dividends in the first year, assuming no change to the payout. Over 10 years on the same 5.9% average yield, this would rise to £6,490, and after 30 years to £19,470.

Not bad, certainly, but it is nowhere near what could be made if dividend compounding was taken into account.

Doing this on the same average yield would give me an extra £8,815 after 10 years, not £6,490. And after 30 years, I would have made an additional £53,300 rather than £19,470!

Adding in the initial £11,000 stake, the total investment in BT would be worth £64,300. That would pay £3,794 a year in passive income at that point.

Inflation would have reduced the buying power of that money by then, of course. And there would likely be tax implications, according to individual circumstances.

However, it firmly underlines how much annual income can be generated over time by investing in high-yielding shares and compounding the dividends.

This post was originally published on Motley Fool