The idea of making passive income from doing very little work may seem too good to be true. But by buying dividend shares, it can actually be pretty simple.

By targeting blue-chip FTSE 100 companies that offer attractive dividend yields, investors can start making cash on the side without much effort.

Granted, all investors must do the correct due diligence before buying any stock. But it’s worth it. Investing in the stock market is a much smarter way to make our money work for us as opposed to leaving it in the bank, especially given how rampant inflation has been over the last couple of years.

What I’d do

The average UK savings pot is around £11,000. So, let’s use that as a base figure. The first thing I’d do with my lump sum would be to put it into a Stocks and Shares ISA.

With my ISA, I could invest up to £20,000 a year and pay zero tax on the returns I made and dividends I received.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

After that, I’d start looking at what sort of stocks I want to buy. Most importantly, I’d build a diversified portfolio of around five to 10 companies. Diversification is key to any successful portfolio.

I don’t want all my investments to be reliant on one company or industry. That would make me more prone to volatility.

One I own

One stock I think could be smart for investors to consider buying today is HSBC (LSE: HSBA). I recently added to my position in the international banking giant.

The business has large ties to Asia and that’s one of the main reasons I own some shares. Asia is the world’s fastest-growing region and with that will come plenty of growth opportunities over the coming decades as demand for banking services keeps rising.

As such, HSBC continues to heavily invest in the region. For a long-term investor like myself, that’s exciting.

Of course, that comes with risk. Ongoing tensions between the US and China will likely heighten regardless of who’s the next US president. China’s struggling economy and property market has weighed down on the HSBC share price in recent times.

But as I said, I’m focused on the bigger picture. And I see the bank’s focus on the area paying dividends in the years to come.

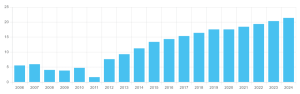

Speaking of dividends, HSBC also boasts a yield of 7.3%, way above the FTSE 100 average of 3.6%. Its payout has been steadily rising in recent years, including a 91% jump last year.

An increasing yield is something I always look for when buying stocks for passive income. Its shares also look dirt cheap, trading on just 7.4 times earnings and 7.2 times forward earnings.

The numbers

Taking HSBC’s 7.3% yield as an average, I’d earn a passive income of £803 a year on my £11,000. But if I decided to reinvest my dividends, then after 25 years I’d make £4,763 a year. That’s assuming no share price movements or change in its dividend, which is always possible.

However, if I decided to invest an extra £300 a month, by year 25 I’d make £22,516 in interest. That works out to £1,876 a month in passive income. By that point, my portfolio could be worth a whopping £322,744.

This post was originally published on Motley Fool