We’d all love a passive income. However, millions of Britons are yet to realise the opportunities that investing in stocks and shares can offer.

By investing through a Stocks and Shares ISA, UK residents can turn a pot of savings, or any money left over at the end of the month, into a sizeable and potentially life-changing passive income.

Nonetheless, it requires patience and a strategic approach to investing. If we start investing with £10,000, it will take time for our portfolio to mature and eventually offer us that mega passive income.

So how’s it done? Let’s take a closer look.

The patience part

Firstly, the Stocks and Shares ISA’s an amazing vehicle for our investments. It’s simply a wrapper that shields our money from tax while allowing us to invest as we please, via a stockbroker platform such as Hargreaves Lansdown.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

While £10,000 might sound like a lot of money, I may want to consider adding to this with monthly contributions. Even something like £200 a month could really add up over time.

What’s more, growth compounds. If I’m investing well and my investments are going up in value, I’ll start to benefit from something called compound returns.

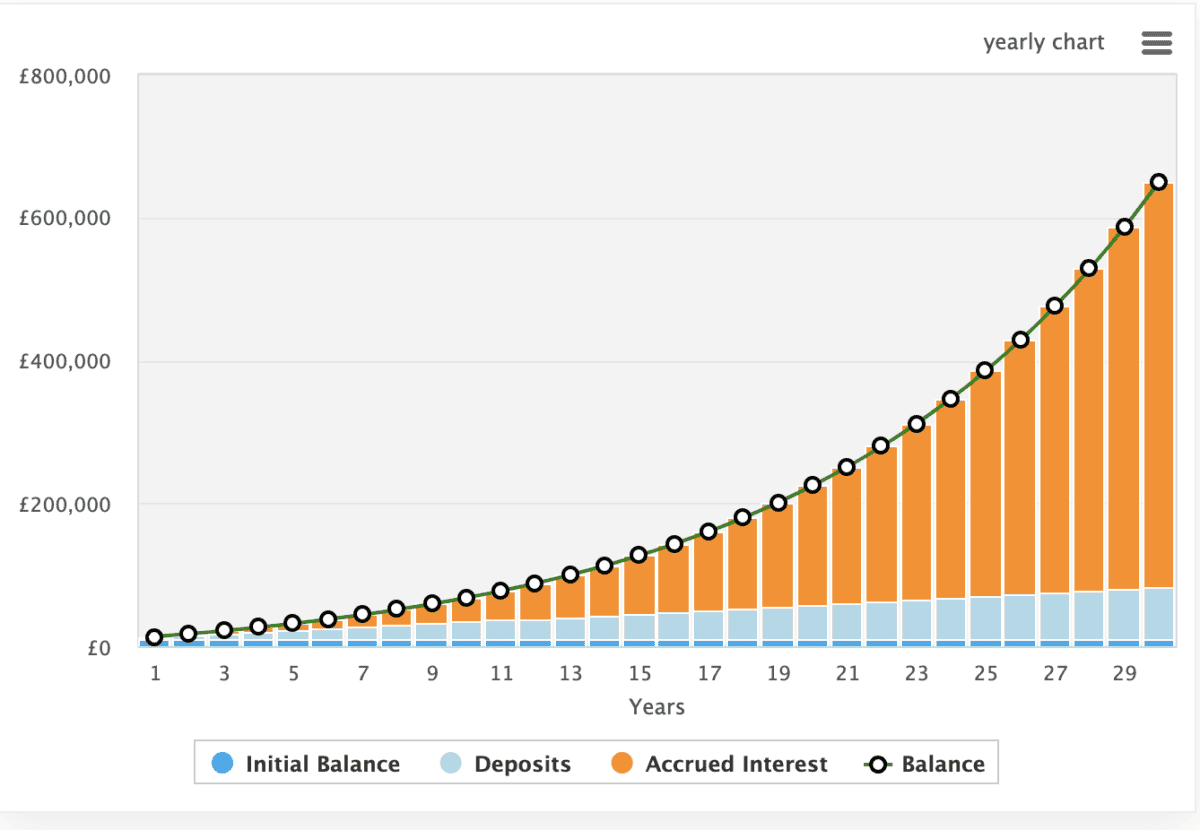

The graph below shows how £10,000 and £200 a month grows at 10% annually over 30 years. At the end of the period, the portfolio is growing by over £60,000 a year — that’s compound returns.

And with £650k, I could earn a passive income worth at least £32,500 annually.

Investing wisely

A friend of mine recently asked me if he should buy Tesla stock. But as he doesn’t have other investments, or any intention of buying other stocks, funds, ETFs (exchange-traded funds), or bonds, it sounded like a risky strategy.

And this is why we need to invest wisely. My largest holdings, which are AppLovin and Celestica due to their meteoric growth, both represent around 7% of my portfolio. And, in all honesty, that’s probably too much exposure to these two companies.

So we either need a diversified portfolio of stocks, or to look at investing in a smaller number funds or ETFs with broader reaches.

An ETF Idea

If I were picking a handful of ETFs, I may want to consider the VanEck Uranium and Nuclear ETF (NYSEMKT:NLR). The fund’s performed well over the past year and five years, returning 18.2% and 49.7% respectively.

The ETF currently has holdings in 25 companies related to the nuclear sector, including Constellation Energy Corp and Uranium Energy Corp. It’s largest holding is US clean energy producer Public Service Enterprise Group Inc.

One drawback is that this sector can be hit hard by changes in public sentiment and government policy. For example, the Fukushima nuclear disaster damaged public sentiment towards the sector globally, while some governments, including Germany, have phased out nuclear power on environmental and ecological grounds.

However, there’s evidence to suggest this could be a fast-growing sector over the next two decades. The UK’s among countries investing in modular nuclear reactors that can be built at a fraction of the cost of traditional power plants, and much quicker.

Moreover, with the ETF pulling back (dropping in value) in recent weeks, it could be an opportunity worth consideration. It’s certainly on my watchlist.

This post was originally published on Motley Fool