Trying to pick through all the odd and improbably passive income ideas can be difficult. Rather than try something risky, savvy investors prefer to focus on a tried-and-tested approach.

For decades, British investors have sworn by the regular income that leading dividend stocks deliver. With the FTSE 100 average yield at around 3.5%, the index promises more lucrative dividend income than its US peers.

With a Stocks and Shares ISA, UK residents can invest up to £20k a year with no tax levied on the capital gains. These self-directed investment accounts allow the holder to pick from a wide variety of assets, including stocks, commodities and investment trusts.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Growing over time

By picking a mix of high-yield stocks, many UK investors have managed to achieve an average yield of around 6%. That would pay only £1,200 a year in dividends on £20k.

By investing the full £20k each year, within eight years, the pot would reach $231,000 (with dividends reinvested). That would pay £12,000 a year in dividends, or £1,000 a month.

Of course, £20k’s a lot to save every year. But even at half that amount (£10k a year) the same dividend income could be achieved in 12 years.

Choosing stocks

A general rule of thumb dictates that a mix of around 10 stocks provides sufficient diversity in a portfolio. Rather than simply pick the highest-yielding shares, many investors also include some defensive shares or index trackers.

These can help keep a portfolio stable during volatile economic periods. Some defensive stocks also pay a decent dividend, for example, Unilever, with a 3.3% yield, or GSK, at 4.5%.

Naturally, these lower-yielding shares would need to be offset by higher ones to achieve a good average. But very high yields can be indicative of financial problems so it’s critical to dig deeper.

One example

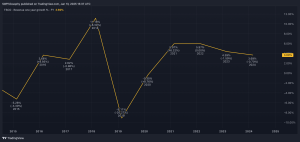

That’s why I like Aviva (LSE: AV). It may have a lower yield than other UK insurers but has a long payment history. I also think it achieves a good balance of allocating funds between the business and dividends.

Looking back, the company has cut dividends several times. This may look bad until you consider how it has used these savings to improve operations. That may be why the share price is up 17.4% in the past five years. Many other UK insurance companies are negative over the same period.

Of course, that doesn’t mean it’s without risk. Like most insurers, Aviva invests in fixed-income securities which are impacted by interest rates. If interest rates fall, it could hurt the company’s bottom line. In the highly competitive UK insurance landscape, it can’t risk losing market share failing to impress customers.

But I think it looks to be in a good position. It surprised analysts in its 2024 first-half results, with earnings coming in 10% higher than expectations. Revenue is now expected to exceed £39bn for the year, considerably higher than the £27.4bn achieved in 2023.

I hold the shares as part of my income portfolio and will continue to drip-feed the investment throughout 2025.

This post was originally published on Motley Fool