Within the FTSE 100 index, I’m keen on IMI (LSE: IMI). The company designs, builds, and services engineered products for fluid and motion control applications. As an industrial business, it can be sensitive to economic cycles, and that’s the biggest ongoing risk for shareholders here.

However, today’s (26 July) news of a 10% increase in the interim shareholder dividend is welcome. It comes with the backing of an encouraging first-half results report, which extends a multi-year period of steady business progress.

Consistent trading and steady growth

But the chart below shows how volatile the stock can be. It would be easy to lose money with this one if general economic conditions deteriorate.

Nevertheless, despite the difficulties for world economies over recent years, IMI’s business performance has been consistent and tilting towards growth. The multi-year record for normalised earnings shows advances each year since at least 2018.

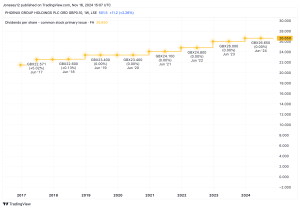

The pandemic doesn’t even register in the earnings record. However, like many businesses, IMI took the step of preserving cash and reducing dividend payments in 2020.

The directors rebased the payment lower by 50% back then, saying at the time the move would enable IMI to “effectively deliver on its long-term growth ambitions”.

I reckon restructuring and growth initiatives have progressed well since then. The firm has been rebuilding dividend payments, and that trend looks set to continue.

City analysts have pencilled in high-single-digit percentage increases for the total annual dividend both this year and next. That means 2025’s total payment will likely be in the ballpark of 33p, up from 22.5p in 2020.

However, with the share price near 1,837p, IMI forward-looking yield’s modest at just below 1.8%.

But the great thing about IMI is the ongoing, well-balanced, multi-year growth in revenue, earnings and cash flow. The business is doing well and expanding. Its performance through the pandemic demonstrates the strong niche the company commands in its markets.

In today’s report, chief executive Roy Twite pointed to a 5% year-on-year increase in organic sales during the first half. That drove a 6% rise in adjusted organic operating profit and the overall performance of the business was “in line with expectations”.

IMI achieved organic growth and profit margin improvements despite “mixed” end markets, Twite added.

A positive outlook

The directors appear confident in the outlook because they also announced a £100m share buyback programme.

When a company buys back and cancels some of its own shares, the earnings and dividends are spread over fewer remaining shares. So that tends to push up the per-share figures, theoretically boosting returns for shareholders.

However, share buybacks only really make sense if the company’s buying good value. With a forward-looking price-to-earnings rating of just under 14 for 2025, IMI looks like it’s priced around the average of all firms in the Footsie.

So the stock isn’t obviously cheap. But to me, the long record of steady trading and progress makes the company look like decent value with an undemanding price tag.

I think it’s one of the best stocks to consider buying in the Footsie.

This post was originally published on Motley Fool