FTSE 100 stalwart British American Tobacco (LSE: BATS) isn’t everybody’s cup of tea. This is for reasons that may be obvious to some, but I’ll make them clear shortly anyway.

However, when it comes to investing, I’m in the business of building wealth, and not necessarily following the crowd.

Here’s why I’d be willing to buy some British American Tobacco shares as soon as I have some investable funds.

Health consciousness

It seems the world has awoken from a slumber in recent years and realised smoking is bad for your health. What a shock that is! Anyway, when you couple that with the rise of ESG investing, tobacco firms like British American are now being shunned by many.

The world’s governments are leading the charge to try and dissuade people from smoking, and are pushing hard. There are also constant threats of law changes that could ban the purchasing of certain tobacco products.

Both of these issues are ongoing risks that could dent British American’s earnings and returns, and something I’ll keep an eye on.

With the changing shift in sentiment in recent years, it’s no wonder the shares have struggled. For context, British American shares are down just 5% over a 12-month period from 2,603p at this time last year, to current levels of 2,457p. Not bad, right? Well, looking back further, they’re down 55% over a seven year period from 5,530p, to current levels.

Dividend king!

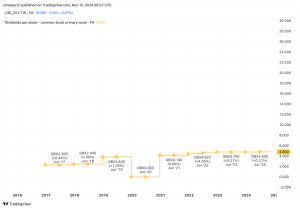

With my goal of building wealth, it’s hard to ignore the passive income opportunity that British American Tobacco offers, as well as its past track record. Although I understand that past performance is not an indicator of the future, the business has raised its dividend for years now. I can’t see that slowing anytime soon.

At present, the shares offer a dividend yield of 9.4%. For context, the FTSE 100 average is 3.8%. However, I do understand that dividends are never guaranteed. Plus, the shares trade on a rock-bottom valuation, with a price-to-earnings ratio of just six.

With low cost, high prices, and such strong brand power, as well as humongous reach, it’s not hard to understand why the tobacco giant has been a dividend-seekers’ favourite in the past. It still is to many at present as well.

But what about the threat of increased regulation? Well, in my view, such regulation could take a long time to come to fruition. By this, I mean the type of timescale that could allow me to bag plenty of dividends. We’re talking years, if not decades.

Furthermore, British American is realising the need to pivot its approach due to the threat of bans. Its alternative tobacco products seem to be flying off the shelf. This new revenue stream could continue to support earnings and generous returns too.

To summarise, the fundamentals and passive income opportunity, look enticing. The threats are credible, but the opportunity to build wealth through dividends is too attractive to miss out to me.

This post was originally published on Motley Fool