Unfortunately, I’ve not had a spare €400,000 lying about recently for a Ferrari (NYSE: RACE). That’s the average selling price (ASP) for a new one nowadays. But I was able to rustle up enough cash to buy a few shares of the Italian luxury automaker a while back for my Self-Invested Personal Pension (SIPP).

The stock has done very well, rising 90% in just the past two years. This is impressive when most other luxury stocks have been smashed due to weak China sales.

Should I add to this winning stock today? Let’s pop the bonnet and take a look.

An exotic animal

At first glance, Ferrari might look like just another manufacturer of sports cars. However, I think it’s more accurate to view the Prancing Horse as the world’s leading luxury brand.

In Q3, the company only sold 3,383 vehicles. But it could likely triple that figure in a heartbeat if it chose to. After all, the cars are built to order for ultra-high-net-worth individual clients, with the order book stretching well into 2026.

The reason it doesn’t sell more is because Ferrari needs to maintain an aura of exclusivity. CEO Benedetto Vigna argues that seeing a Ferrari on the road should be like encountering an exotic animal.

Unfortunately, even if I had €400,000, I probably wouldn’t be able to buy a new Ferrari. There’s a massive waiting list to even be considered as a potential customer, while 74% of cars made last year were sold to existing clients.

Ferrari will always deliver one car less than the market demands.

Enzo Ferrari

Serious pricing power

This scarcity gives the company incredible pricing power. As mentioned, the ASP is now around €400,000, up from €270,000 in 2015. Some special models exceed $1m.

The firm is also benefiting from customers enthusiastically paying up for increasing amounts of vehicle personalisations (extremely high-margin revenue).

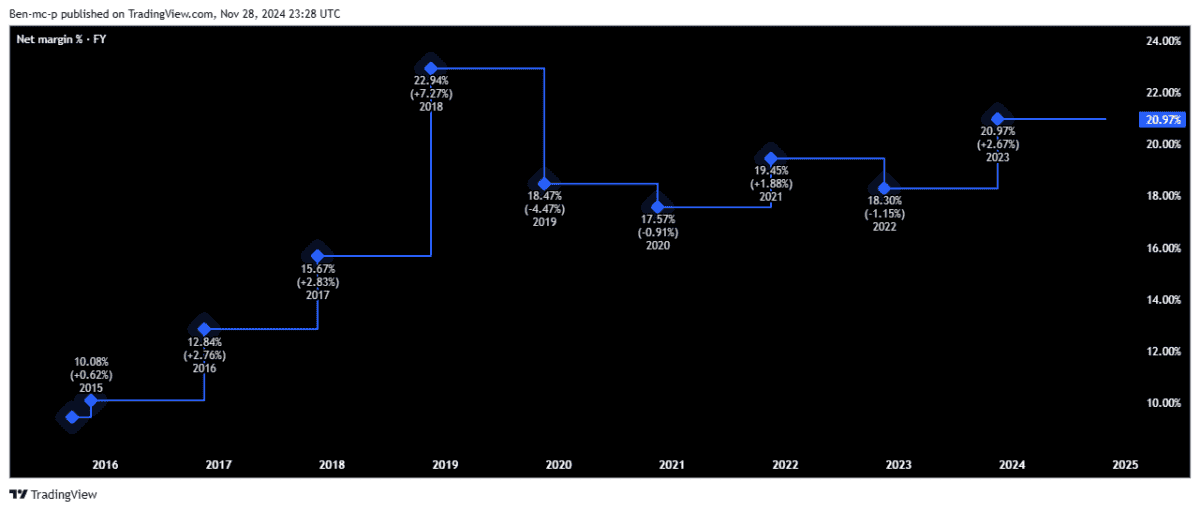

As we can see below, Ferrari’s net margin has more than doubled inside the last decade, from 10% in 2015 to an incredible 21% today.

Most auto firms are high-volume, low-margin producers. Ferrari has flipped that on its head, with ultra-high margins on low volumes.

Brand image risk

Some investors might still question the investment case for this stock. After all, if the firm closely limits supply to maintain high demand, where’s the growth going to come from long term?

It’s a valid question, and Ferrari’s continued success is linked to the growing population of multi-millionaires and billionaires. Current trends indicate that this affluent (and aspirational) demographic is expanding, particularly in Asia.

This should enable Ferrari to gradually increase its annual production volumes while maintaining the brand’s exclusivity. It’s also moving onto the water by launching a sail racing team and building a racing yacht.

Yet the brand image is everything here. If that were to somehow diminish, then the company’s reputation and ultimately pricing power would be threatened.

Will I buy more shares?

I’ve been waiting for a decent pullback in the share price all year. There’s been a slight one — 13% since August — but it’s not enough for me. The stock’s still trading on a high forward price-to-earnings (P/E) ratio of 47.

That’s actually above luxury peer Hermès (43).

Therefore, I’ll continue waiting patiently for my opportunity to buy more shares.

This post was originally published on Motley Fool