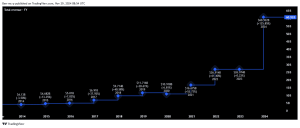

The owner of British Gas, Centrica (LSE: CNA), has been a consistent disappointment for some shareholders. After topping £4 in 2013, the Centrica share price fell to pennies in 2019. Since then, it moved up as high as £1.70 in September last year, before declining to its current price.

Still, the share price growth over five years has been an impressive 57%. On top of that, the share trades on a price-to-earnings ratio of just six. So might this be the sort of bargain share I should consider buying for my portfolio?

Challenging industry with long-term demand shifts

To start, why has the Centrica long-term share price performance been so mixed?

The business has evolved substantially over the years. But at its core is a gas business that faces multiple challenges. One is a seemingly endless list of customer and employee complaints stretching over many years. But a bigger structural challenge is the long-term decline of gas use in the UK. On top of that, energy price movements can work in the firm’s favour, but also against it.

That makes for an unpredictable performance from one year to the next. It also means I have doubts about the long-term attractiveness of the business model. There is a reason that the share is worth barely a quarter now of what it was back in 2013.

Significant cash generation potential

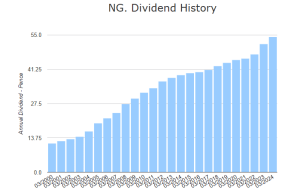

One of the things I like about the business is its cash generation potential. The current yield is 3.3%. The payout is handily covered by current earnings. If that continues to be the case, there is potential for a much larger payout. The current dividend remains far below what it once was.

The first half saw basic earnings per share of 25.1p. Compared to the current share price, those earnings are very juicy – bear in mind they only cover a six-month period. Centrica ended the first half with net cash of £3.2bn. That is equivalent to roughly half its current market capitalisation.

Potential bargain, but I see risks

On that basis, I am a bit torn. Not only does the valuation look cheap, but Centrica is sitting on a large cash pile. If earnings stay strong, that could grow substantially. At some point it could fund a large special dividend or business growth.

But I have been burnt by Centrica in the past and question whether the share price is the bargain it looks. Earnings have moved around a lot historically and I expect that to continue.

Gas demand is likely to keep falling. Centrica says recent spending has driven “marked improvements in customer service” but I reckon its tarnished consumer brands will take a long time to regain the trust of some customers.

I think this share could turn out to be a bargain at the current price. But the business model has proven both unpredictable and disappointing in the past and I think that may still be the case, so I have no plans to invest.

This post was originally published on Motley Fool