As 2025 approaches, thoughts are naturally turning to the future. For me, building a growing passive income stream is top of mind, with dividend shares making up an important part of my overall portfolio.

Here, I’ll outline my simple three-step dividend plan in 2025.

Obey the five-year rule

Before allocating money to investments in the New Year, it’s essential I’m doing so on a firm financial footing.

How much can I afford to invest without impacting my living expenses or emergency savings? I ask this because it’s easy to get carried away in this age of ultra-high dividend yields in the UK stock market.

For example, I notice the forward yield on FTSE 100 insurer Legal & General (LSE: LGEN) has crept back up towards 10%. That means I could be looking at nearly £200 in passive income next year from a £2,000 investment.

A near-10% yield tempts me to dip into my savings right now and buy more shares for my portfolio!

But I have to stay disciplined. Christmas is coming, which always works out more expensive than planned (at least for me). And my car’s got its MOT in December, and you never know what problem could be found lurking under the bonnet.

There’s no point buying shares if I have to sell them again a few months later because an emergency crops up.

A good rule of thumb is to only invest money one doesn’t need for the next five years (i.e., the five-year rule). This is sufficient time to ride out market fluctuations and benefit from compounding growth.

Invest in blue-chip dividend shares

Dividends are never guaranteed to be paid by companies, while share prices can fall as well as go up. However, I hope to minimise these risks by focusing on high-quality, blue-chip dividend stocks.

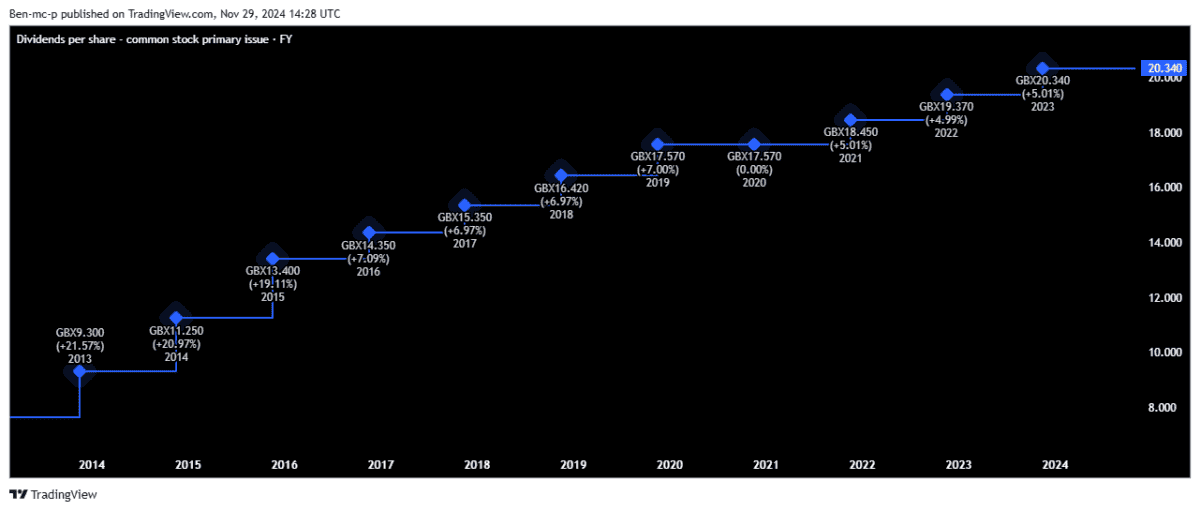

Returning to Legal & General, this stock has what I’m looking for. The insurance and asset management stalwart has decades of experience growing its dividend. I value this solid track record.

In H1 2024, we learned that the firm’s Solvency II coverage ratio was 223%, with surplus of £8.8bn. This indicates the company’s capital position is very robust.

Admittedly, the share price has been disappointing this year, falling around 11%. And the UK economy isn’t exactly firing on all cylinders. Were a downturn to occur, that could lead to reduced consumer spending, potentially impacting the firm’s insurance and savings businesses. So that’s a risk to consider.

Longer term, I still believe the company is well placed to capitalise on the UK’s ageing population. This should lead to increased demand for pension and retirement products.

With the forward yield approaching 10%, and management committed to modest increases in future, this is one I can see myself adding to in 2025.

Stay diversified

While I’m bullish on the stock, I have to accept that it could turn out to be a disappointment long term.

Therefore, diversification is crucial. My portfolio contains dividend stocks, a handful of investment trusts, and growth shares (some of which also pay dividends).

It might be tempting to go all-in when I see a massive yielder like Legal & General. However, I also like to sleep well at night. Making sure my portfolio is well-rounded will therefore remain very important in 2025.

This post was originally published on Motley Fool